Multiple stock market corrections per year are normal

Main Points

- Global trade war fears drove a 4.5% correction in the S&P 500 in May.

-

Multiple stock market corrections per year are normal.

-

Corrections provide opportunities to buy investments at attractive valuations.

After the fourth-quarter meltdown, where U.S. stocks dropped nearly 20%, the U.S. stock market returned to its low volatility ways in the first quarter of 2019.

By early May, the market had gone 87 trading days without a 3% correction, the second-longest streak since the March 2009 market low.

However, by mid-May, global trade war concerns spooked investors, sending the S&P 500 down 4.5% to 2811.87. Sectors and companies with exposure to China were hit the worst, some down double digits.

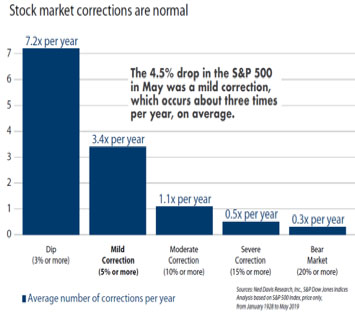

Keep in mind that stock market corrections are normal. The S&P 500 averages 3.4 corrections of at least 5% and 1.1 corrections of at least 10% in any year (chart below). Drops of 15-20% or more happen less frequently.

According to Ned Davis Research, it would likely require more problems beyond the trade war for the latest pullback to worsen into a double-digit correction.

They’re watching the Fed, earnings, and the percentage of stocks above their 200-day moving averages for signs that the pullback is spreading beyond multinationals that are exposed to China trade.

Stock market corrections really aren’t an issue if you remain focused on the long term. For the long-term investor, a stock market correction is often a great time to pick up new investments at attractive valuations. Additionally, it could provide an opportunity to buy or add to existing positions. It’s also a good time to review asset allocations.

If the trade war pushes the U.S. economy into a recession, the stock market correction could get worse, potentially to “bear market” levels.

With some resolution on the U.S.-China trade discussions, investors could get refocused on a growing U.S. economy and the stock market could

Investment Advisory Services provided by Wall Advisors, Inc a Registered Investment Advisor. The opinions expressed herein are those of Wall Advisors, Inc and Ned David Research and are subject to change without notice based on market conditions and economic changes. This commentary is for educational purposes only and should not serve as financial advice or an offer to sell any product.