The potential Tax, Economic, Tax Revenue (Government) and Distributional effect of a Biden Presidency. At Wall Titus one of the core values of our firm is to relay timely, credible, accurate information to our clients, family and friends so that we may serve you in the most efficient and effective way.

A Close look at some highlights of President-Elect Joe Biden’s tax plan.

Let’s start with a condensed summary of President-Elect Biden’s tax plan:

- Repeal the “Tax Cuts and Jobs Act” passed in 2017.

- Impose 12.4% Social Security payroll tax for wages above $400K

- Increase the corporate income tax rate to 28%

- Establish a corporate minimum tax on book income.

- Double the tax rate on Global Intangible Low-Taxed Income, income from investments in foreign companies. The current rate is 21% which was included in the 2017 tax reform act. However, the current treatment of this tax gives flexibility to reduce the tax to 10.5% and if done correctly allows you to move your money as you see fit. You can leave your taxed earnings overseas or bring it to the United States with no additional impact. The GILTI is complex; however, the days of deferring foreign income have been over since the Tax Cuts and Jobs Act of 2017. Under the Biden administration we believe not only will the tax rate potentially double but the flexibility, referred to in the previous text, will be restricted.

- Temporarily increase the Child Tax Credit and Dependent Credit.

- These are only a few of the highlights. Let’s get into additional details of a few important items President-Elect Joe Biden released included in his plan before the election. It is important to expand upon a few key components of President-Elect Biden’s tax plan, which he consistently referred to in the race for President.

Highlights of Biden’s tax Plan which affect payroll taxes, Individual Income taxes and Estate and Gift Taxes:

The Biden plan imposes a 12.4 percent Old-Age, Survivors, and Disability Insurance (Social Security) payroll tax on income earned above $400,000, evenly split between employers and employees. The concern is this would create a gap in the current Social Security payroll tax, where wages between $137,700, the current wage cap, and $400,000 would not be taxed. We can not predict how this will affect the entire social security system and fund reserves.

The Biden plan reverts the top individual income tax rate for taxable incomes above $400,000 from 37% under the current law to the pre-Tax Cuts and Jobs Act level of 39.6%. The Biden plan phases out the qualified business income deduction (Section 199A) for taxpayers with taxable income above $400,000. This could drastically affect many taxpayers who run qualified businesses and have benefited from the QBI deduction since it was passed in 2017.

The Biden plan expands the “Child and Dependent Care Tax Credit” from a maximum of $3,000 in qualified expenses to $8,000 ($16,000 for multiple dependents) and increases the maximum reimbursement rate from 35 percent to 50 percent.

The Biden plan reestablishes the First-Time Homebuyers’ tax credit, which was originally created during the Great Recession of 2006 to help the housing market. Biden’s homebuyers’ credit would provide up to $15,000 for first-time homebuyers.

The Biden plan expands the estate and gift tax by restoring the rate and exemption to 2009 levels and eliminates the long-standing step-up in basis at death rule. Many taxpayers will be advised to analyze their current Estate Plan and to make the necessary changes needed to minimize the Estate Tax. We advise seeking professional guidance, as each Estate Plan is unique.

Highlights of Biden’s tax plan which affect Business Tax:

The Biden Plan increases the corporate income tax rate from 21 percent to 28 percent. To expand on one of the bullet points above, the proposed plan creates a minimum tax on corporations with book profits of $100 million or higher. The minimum tax is structured as an alternative minimum tax. Corporations will pay the greater of their regular corporate income tax or the 15 percent minimum tax. The Biden proposed plan still allows for the inclusion of any net operating losses and foreign credits.

The Biden plan establishes a “manufacturing communities tax credit” to reduce the tax liability of businesses that experience workforce layoffs or a major government institution closure. The proposed plan expands several renewable energy-related tax credits. Conversely, the plan would end tax subsidies for fossil fuels.

The Biden plan, in an effort “to fight for workers by delivering on buy America – make it in America,” imposes a new 10 percent surtax on corporations that use offshore manufacturing and service jobs to foreign nations in order to sell goods or provide services back to the American market. This surtax would raise the effective corporate tax rate on this activity up to 30.8%.

There are many other changes; it is not practical to lay them all out in this brief update. Therefore, we have summarized the projected bottom-line effect of President-Elect Biden’s plan. We pulled projections from several respected industry entities and compared the different projections to the “Tax Foundation General Equilibrium Model” from October 2020.

Economic Effect of Biden’s tax plan:

“The Biden tax plan would reduce the economy’s size by 1.62 percent in the long run. The plan would shrink the capital stock by approximately 3.75 percent and reduce the overall wage rate by a little over 1 percent, leading to about 542,000 fewer full-time equivalent jobs. The model estimates, on a conventional basis, Biden’s tax plan would increase federal tax revenue by $3.3 trillion dollars between 2021 and 2030 relative to the current law.”

1. Gross Domestic Product (GDP) (1.62%)

2. Full-Time Equivalent Jobs (542,000)

3. Wage Rate (1.15%)

4. Apply a Social Security tax of 12.4% to earning >$400k (.18%)

5. Restore estate and gift taxes to 2009 levels (.15%)

6. Total Economic Effect of The Biden Tax Plan (1.62%)

7. Conventional Tax revenue 2021-2030 (trillions) +$3.3

8. Dynamic Tax Revenue 2021-2030(trillions) +$2.8

(The difference in projected Conventional and Dynamic tax revenue (#7 & #8) is a result of the projected smaller economy. The tax base would shrink for payroll, individual income tax and business income tax.)

*Source: Tax Foundation General Equilibrium Model, October 2020

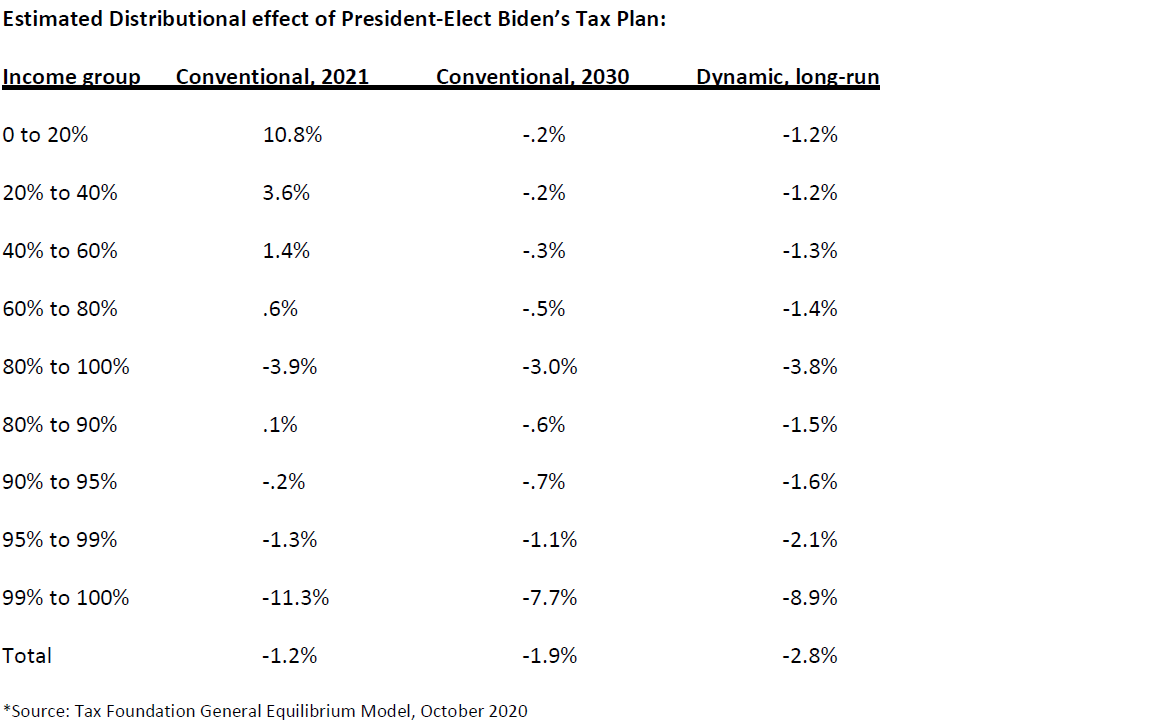

President-elect Biden, according to the tax plan he released before the election, would raise taxes on labor income, investment income, and business income of those earning over $400,000. Additionally, Biden’s Plan has proposed a variety of new tax credits or expansions to existing credits to help increase after-tax incomes for low earners. Biden’s plan would raise about $3.3 trillion in tax revenue over the next decade on a conventional basis, $2.78 trillion after accounting for the reduction in the size of the U.S. economy. While taxpayers in the bottom four quintiles would see an increase in after-tax incomes in 2021, primarily due to the temporary CTC expansion, by 2030 the plan would lead to lower after-tax income for all income levels.

At Wall Titus we are dedicated to our Client Family, providing current and ever-changing proposals, facts and modeling to stay at the forefront of our profession. Please feel free to call if you have any specific questions or concerns regarding the proposed tax plan of President-Elect Biden.

** The factual data and modeling comprised within this Tax Update was obtained from over 15 creditable professional industry sources. [i]

U:\Admin\Biden tax plan review 11.11.20

Investment Advisory Services provided by Wall Advisors, Inc a Registered Investment Advisor. The opinions expressed herein are those of Wall Advisors, Inc and Ned David Research and are subject to change without notice based on market conditions and economic changes. This commentary is for educational purposes only and should not serve as financial advice or an offer to sell any product.