Though September has historically been “the worst month for the stock market,” our experts agree that there’s no need to fear based on the calendar month. We’re here to ease your worries! Consider these reasons from CNN Money and commentary from our founding partner at Wall Titus, H. Lee Wall.

“We think it is a good time to be cautious as markets have not been affected by geopolitical events, but the calendar should have little to do with the next move in the markets. Earnings will drive the markets in the long term.” – H. Lee Wall, CPA/PFS, CFP

4 Reasons Why You Shouldn’t Fear September

By Paul R. LaMonica – CNN Money, The Buzz

September has historically been the worst month for the market.

So with stocks near record highs, should investors be worried about a big September swoon once the Hampton Jitney returns to Wall Street after Labor Day?

Many experts say no. Here are 4 reasons why.

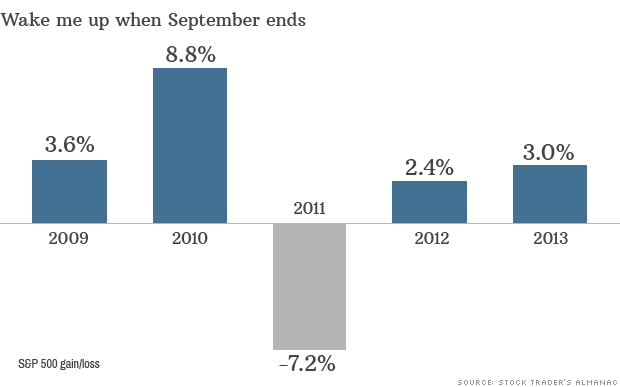

1. September has a bad reputation. Yes, September is often a terrible month for the market. The numbers (and the Stock Trader’s Almanac) don’t lie. The S&P 500 has recorded an average drop of 0.5% in September since 1950.

But recent history may be more important to consider. During the past five Septembers, stocks have enjoyed solid gains every year except in 2011 — the month after Standard & Poor’s cut the credit rating of the United States and while the euro debt crisis was in full swing. (September 2008 was, of course, a month to forget as well.)

So don’t use the calendar to make your investing decisions.

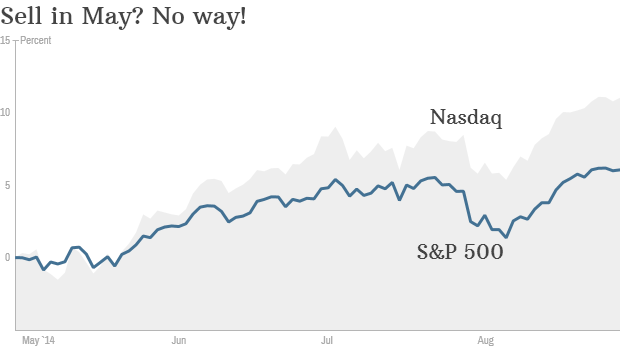

If you sold in May of this year and went away, here’s what you missed.

When stocks have gone down in September, it’s not because it was September. It was because there was bad news to justify a sell-off. Which brings me to my next point …

2. The U.S. still looks healthier than the rest of the world. The economy bounced back in the second quarter after a horrible first quarter. The job market is heating up. Earnings growth has been decent and revenues are actually on the upswing too — a sign that businesses are benefiting from actual demand and not just cost-cutting.

“When push comes to shove, Corporate America is doing really well,” said John Norris, managing director with Oakworth Capital Bank.

Related: Apple and other well-known stocks are at all-time highs

Yes, there are lots of scary things going on around the globe. ISIS. Ukraine. Ebola.

But Norris said investors often tend to look inwards when global risks are mounting. And American investors aren’t the only ones who realize this.

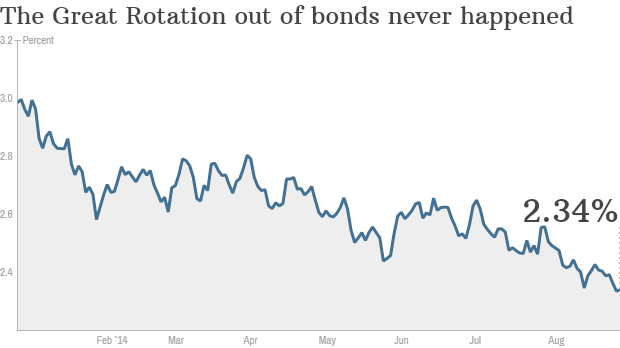

3. The rest of the world loves the U.S. too. U.S. stocks aren’t the only financial asset in the middle of a bull market. American bonds have continued to rally this year, defying expectations for a big pullback that many experts were predicting as the year began.

The yield on the 10-year Treasury is hovering around 2.34% as investors keep buying bonds and push rates lower. The yield at the beginning of 2014 was slightly above 3%.

Shouldn’t bond prices be plunging and yields soaring as investors pull money out of these so-called safer assets and plow them back into stocks? To quote my kindergarten-bound son’s new favorite saying: What the heck?

Related: Find the right investment mix for your retirement portfolio

Simply put, investors in Europe and Asia are interested in U.S. bonds and stocks because of geopolitical turmoil. Anthony Valeri, market strategist at LPL Financial, says that the threat of deflation in Europe is a key reason why U.S. assets are more attractive.

“Europe has a strong gravitational pull on the market right now,” Valeri said.

China and Japan, which each own more than $1 trillion in U.S. government debt, may keep buying bonds as well. Due to such strong foreign demand, Sharon Stark, chief market strategist with D.A. Davison, said that she would not be surprised to see the 10-year yield fall as low as 2.15% in the next few weeks.

4. Investors STILL doubt the bull market. This is key. Even though the S&P 500 is staying near the gaudy sounding level of 2,000 and private startups like Snapchat, Uber and Airbnb are commanding valuations above $10 billion, most stocks are still trading at reasonable, if not exactly cheap, levels.

This is not a bubble like 1999. And that’s because many investors have remained on the sidelines due to memories of the financial crisis. CNNMoney’s Fear and Greed Index, a measure of seven gauges of market sentiment, has been in Fear mode for the past month.

“Unlike the late 90s, people think stocks are still risky. Everyone has the bad taste of 2008 in their mouth,” said Marty Leclerc, chief investment officer of Barrack Yard Advisors.

Related: S&P 500 finally tops 2,000

Now this may not mean that stocks are going to have a huge rally in September. Valeri said a brief pause for the market makes sense as traders come back from vacation, the corporate news cycle picks up and volume increases.

At some point, the people who keep questioning the market may have no choice but to hold their nose and jump in. Stark points out that investors waiting for bond rates to rise and stocks to fall “have left a lot of money on the table.”

As cliche as it may sound, sometimes you just can’t fight momentum — even if it doesn’t seem to make sense.

“The psyche for the market is for stocks to go up,” Norris said.