The U.S. Stock Market Correction Could Worsen

Smartest game plan: review the stock weightings in your portfolio

Election uncertainty, trade wars, and rising interest rates made for a recipe of investor concerns in October. After falling for 21 out of 27 sessions, the S&P dropped 9.9% or about 290 points to a low on October 29. The Dow Jones Industrial Average has fallen 2,385 points or 8.9% from its high. Losses in the Nasdaq Composite (-13%) and the small-cap Russell 2000 Index (-15%) have been steeper.

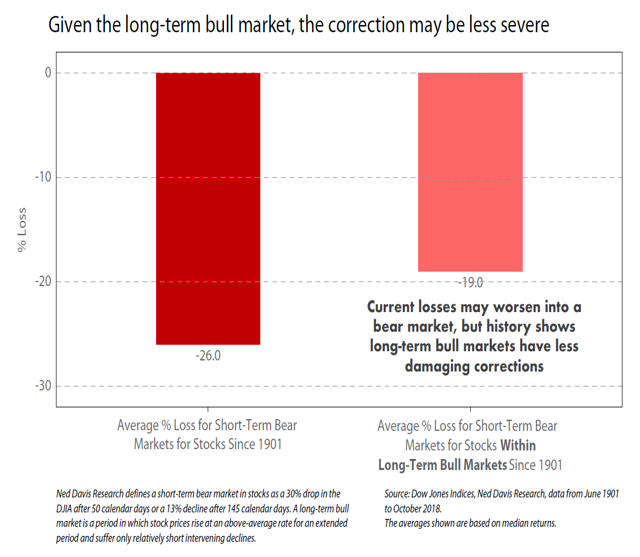

Investors should consider reducing stock allocation. With the global economy slowing and earnings growth decelerating, the stock market correction could continue and could be worse than the 2011 (-16.8%) and 2015-2016 (-14.5%) bear markets. According to Ned Davis Research, the average short-term bear market loss is -26%, using the Dow Jones Industrial Average back to 1901 (shown in the chart at right). When stocks have been in a long-term uptrend (like they have been since March 2009), the average short-term bear market has fared slightly better, showing a loss of -19%. Therefore, it is prudent to review your portfolio stock weightings.

With the world interconnected, global stocks led the U.S. slide by eight months. Some international stock markets are down 20% or more, which is considered bear market territory.

After such severe losses, there is almost always a retest during which investors see if the market can stay above its prior low (2,641 for the S&P 500). A successful retest would include a smaller percentage of stocks making new lows. Multiple big one-day gains can also confirm a low is in place.

This week could spur a rally. Typically, the stock market notches its strongest gains following U.S. midterm elections. In fact, the fourth quarter of a midterm election year is the strongest (+7.5%) of all 16 quarters in a presidential cycle.

Bottom line: look for signs that the correction is over. In the meantime, review your stock weightings.