How the U.S. Government Shutdown Could Impact You

-

Expect weaker economic growth in Q1 due to the U.S. government shutdown.

-

Slower economic growth could cause a short-term drop in the stock market.

-

Increasing policy uncertainty is likely to cause wild swings in the financial market.

We’ve just experienced the longest partial government shutdown in U.S. history (35 days). And we’re at risk of having another shutdown in mid-February.

Three ways this could impact you and your portfolio:

- Expect weaker economic growth in Q1.

Past shutdowns have slowed economic growth in the months that have followed. Economic slowing after shutdowns is typically short-lived, but may linger longer this time.

Estimates vary between 0.1% and 0.2% subtraction from real GDP growth for every two weeks that the government was partially closed.

According to the Bureau of Economic Analysis, the 2013 shutdown, which lasted for 16 days, subtracted 0.3% from real GDP growth in Q4 of that year.

Trump’s own economic policy advisors think the impact could be worse – a reduction of 0.13% each week the shutdown continued.

- Slower economic growth could cause the stock market to drop.

Stock market performance is driven by expected economic growth and earnings expectations. So weaker-than-expected growth could cause short-term weakness in stocks, but it shouldn’t derail the longer-term bull market.

- Increasing policy uncertainty is likely to cause wild swings in financial markets.

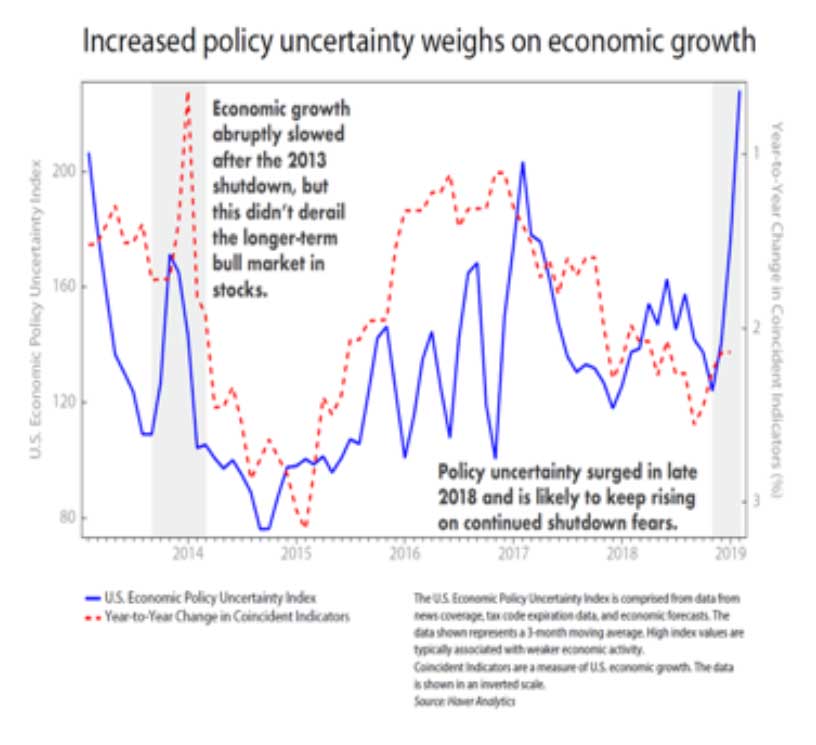

The dysfunction in Washington has resulted in a spike in the Economic Policy Uncertainty Index, a measure of sentiment, as shown above.

Policy uncertainty has historically been detrimental to business spending and weighs on overall economic growth.

Investors don’t like uncertainty — so expect more wild swings in the financial markets until the cloud of uncertainty is permanently lifted.

Investment Advisory Services provided by Wall Advisors, Inc a Registered Investment Advisor. The opinions expressed herein are those of Wall Advisors, Inc and Ned David Research and are subject to change without notice based on market conditions and economic changes. This commentary is for educational purposes only and should not serve as financial advice or an offer to sell any product.